Article

Leveraging clean energy tax credits through home improvements

May 26, 2023

Going green and saving money at the same time sounds like a win-win situation, and that’s exactly what the home energy tax credits aim to do. Homeowners who make energy-efficient improvements to their primary or secondary residence may qualify for two tax credits, the Energy Efficient Home Improvement Credit and the Residential Clean Energy Credit.

The Energy Efficient Home Improvement Credit applies to existing homes and covers a wide range of qualifying costs, including exterior doors, windows, skylights, and insulation materials, as well as central air conditioners, water heaters, furnaces, boilers, heat pumps, and biomass stoves and boilers. Home energy audits also qualify for this credit.

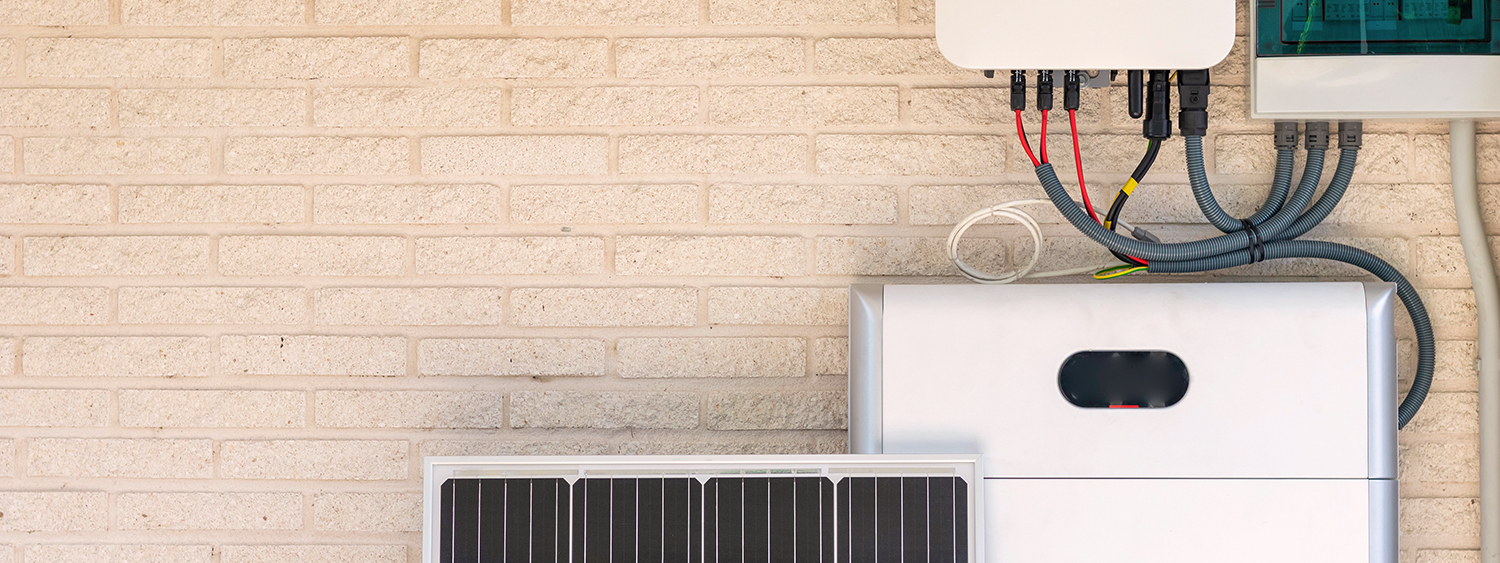

The Residential Clean Energy Credit covers qualifying costs for both existing and newly constructed homes. These costs include solar, wind, and geothermal power generation equipment, solar water heaters, fuel cells, and battery storage.

Both credits offer a percentage of the total improvement expenses in the year of installation. The Energy Efficient Home Improvement Credit provides 30% of expenses up to $500 lifetime maximum in 2022, and up to $1,200 annually with no lifetime limit from 2023 to 2032, with a separate annual credit limit of $2,000 for biomass stoves and boilers. The Residential Clean Energy Credit provides 30% of expenses with no annual maximum or lifetime limit from 2022 to 2032, 26% in 2033, and 22% in 2034.

As the focus on clean energy continues to be at the forefront of national policy, it’s important for taxpayers to understand the tax credit options associated with energy efficiency upgrades. Even small modifications or improvements to home energy practices can qualify for tax savings through these credits and our team at Abdo can help taxpayers take advantage of these.

To claim these credits, taxpayers must file Form 5695, Residential Energy Credits, with their tax return. It’s essential to keep in mind that landlords can’t use these credits for improvements made to any homes they rent out, and renters may claim specific costs in some cases.

While these credits can significantly reduce the costs of energy-efficient home improvements, taxpayers should also be aware of exaggerated claims that companies trying to get their business may make. It’s always best to do thorough research, get multiple quotes, and consult a professional before making any significant home improvement decisions.

Looking for more information on these credits and how you can leverage them? Reach out to Abdo’s tax team to learn more and discuss your options.

Meet the Expert

Clean energy tax credits featured in the Inflation Reduction Act

The Inflation Reduction Act (IRA) features several renewable energy and...

Updates to the Clean Vehicle Tax Credit Starting in 2023

Are you hoping to qualify for a clean vehicle tax...