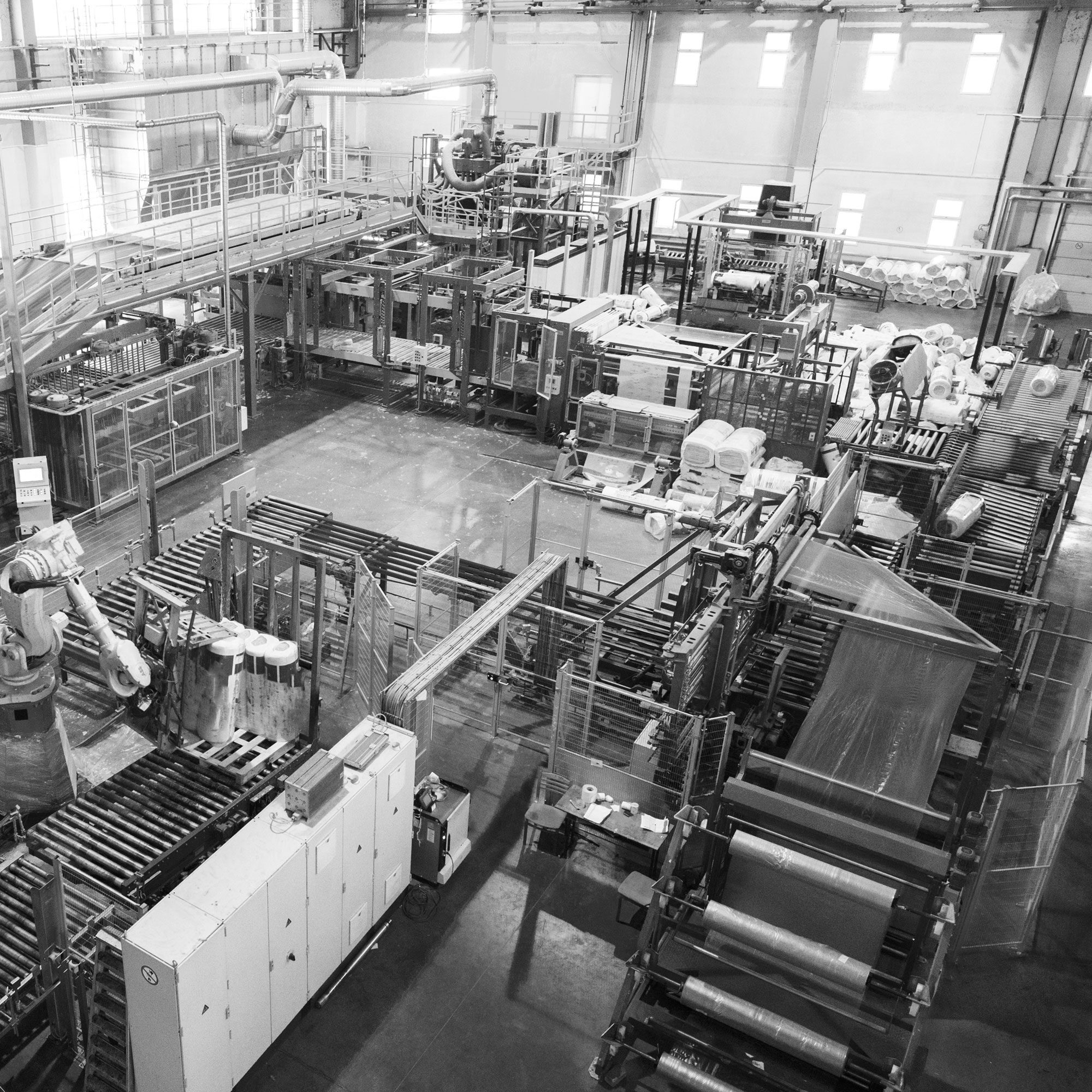

Manufacturing

Ensuring your company stays ahead of the curve

We stand ready to help our manufacturing clients navigate changing regulations, economic conditions, supply costs, and competition, tracking the newest developments and anticipating potential impact.

Keeping up with the changes in manufacturing is challenging enough; staying on track to achieve profit goals is yet another set of challenges. Our team of manufacturing advisors guide the way beyond tax and audit services, bringing deep understanding and proactive solutions that become an integral part of your operations.

From overhead analysis and entity selection to debt and entity restructuring and research and development tax credits, our experts help spark confidence in the future of your business.

R&D Tax Credit

Expert guidance and completion of R&D studies to lower tax liability and increase cash flow.

Audit Services

Our fluency in the language of financial statements means assurance to all stakeholders.

Tax Services

Our holistic approach to managing taxes ensures an integration of business and personal goals.

HR & Payroll

Our focus on complete, customized solutions leads to innovative ways to address today’s HR challenges.

M&A Advisory Services

Comprehensive strategy and support to drive value for prospective sellers or buyers.

Business Valuation

Complete, timely valuation as well as ongoing advice to maximize company value.

Case Study

Empowering a Manufacturer in a Changing Marketplace

Dayton Rogers’s ability to handle complicated metal forming jobs is unmatched. However, the company’s history and age made adapting to a changing marketplace feel like an overwhelming hurdle.

“Abdo is a true partner—they don’t just give us the numbers. They’re a business advisor first, and an accountant second.”

—Dave Fenske, Dayton Rogers CEO

Insights

A behind-the-numbers view of best practices and holistic thinking.

Arizona Qualified Facility Tax Credit: How manufacturers can maximize savings

The Arizona Qualified Facility Tax Credit could provide you with powerful tax savings- here’s what you should know about it.

How the changing landscape of bank covenants could impact your manufacturing business

Traditional lenders are becoming less flexible on bank covenants. Abdo partner and business advisor Darin Styles spotlights a few things to consider.

Manufacturing expertise

Guiding you to the best way forward

Our industry-specific experience delivers proactive problem-solving for any challenge.

Tyler Petzel, CPA

Tyler illuminates important tax savings for his clients with his expertise in changing tax law and knowledge of the R&D tax credit.

Proudly affiliated: