Article

Non-monetary donations: What to do with kindness in-kind

Donations to a nonprofit organization can come in all shapes and sizes—not only in the form of dollar bills. Depending on the nonprofit’s mission, it might accept anything from website design services to clothes and toys. These non-cash donations are called in-kind contributions, and they come with their own set of requirements—that apply to both the nonprofit and its donors.

Whether you’re a nonprofit receiving donations or a donor making one, it’s important to know your responsibilities.

First, what are nonprofit in-kind contributions?

In-kind contributions are any goods or services that are provided to your nonprofit organization for free or at a reduced cost. Common types of nonprofit in-kind contributions include household items, equipment, supplies, and furniture, rent, advertising, stock, as well as professional services such as photography, design, marketing, accounting, and legal services.

In-kind contributions could also include bigger-ticket items such as motor vehicles, planes, and boats, too (these require the completion of special tax forms). The information included in this article applies only to donated goods.

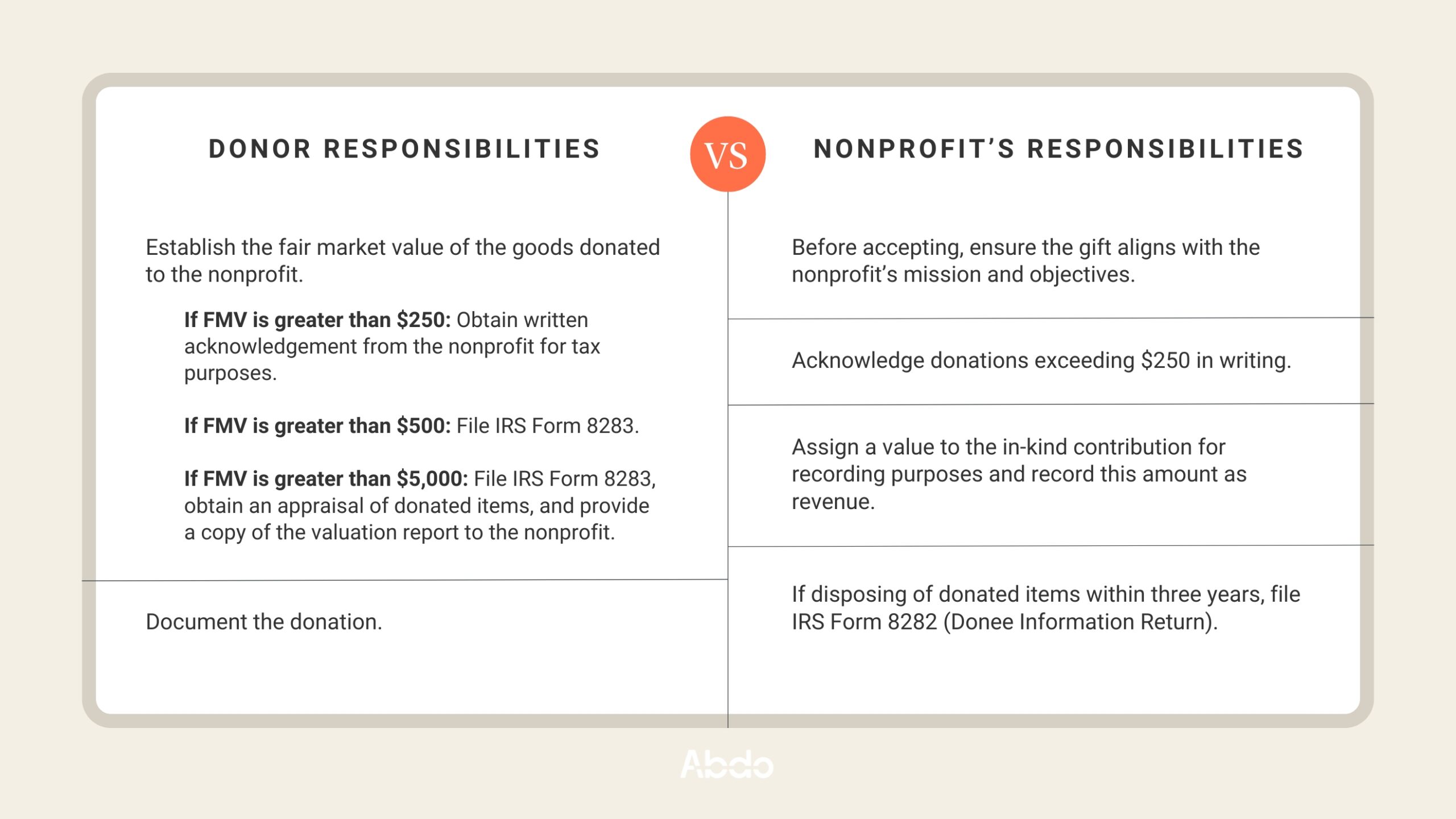

The donor’s responsibilities

Establish the fair market value of the goods donated to the nonprofit. The donor is responsible for establishing the fair market value of their donation for their tax deduction. For example, if a donor were to drop off a box of dog toys at a nonprofit animal rescue, the donor would be responsible for assigning a value to it.

For donations with a fair market value of more than $250: The donor must obtain written acknowledgement of the donation from the nonprofit for tax purposes.

For donations with a fair market value of more than $500: If the donor donates an item or a group of items valued at more than $500, they must complete IRS Form 8283 (Noncash Charitable Contributions) and attach it to their tax return.

For donations that include a single item or group of similar items with a fair market value over $5,000: In addition to completing IRS Form 8283, the donor must obtain an appraisal of the items and provide a copy of the valuation report to the nonprofit.

Document the donation. The donor must keep a record of the donation. This documentation should include a description of the item(s), the date and location of the donation, and any conditions attached to the donation.

The nonprofit’s responsibilities

Ensure the gift aligns with the nonprofit’s mission and objectives. As with any donation, the nonprofit is responsible for making sure a donor’s gift is desired (i.e., in line with the organization’s gift acceptance policy) and used effectively and ethically.

Acknowledge in-kind contributions exceeding $250 in writing. While it’s the donor’s responsibility to request a written acknowledgement of a donation, it is best practice to provide the donor with written acknowledgment, when its value exceeds $250. The acknowledgement should describe the item(s) received without mentioning the item’s value. The letter should also include a statement confirming that no goods or services were received in exchange for the contribution.

Assign a value to the in-kind contribution for recording purposes. Although the donor may set a fair market value, the nonprofit also has responsibility to assign a fair market value for recording the in-kind contribution amount.

For accounting purposes, in-kind contributions count as revenue and should be recorded as such in the nonprofit’s books. Recording in-kind contributions allows you to understand the true cost of running your organization. It’s important to capture and budget for the time and resources these in-kind contributions provide.

If disposing of donated items within three years, file IRS Form 8282 (Donee Information Return). If the nonprofit sells, exchanges, or otherwise disposes of a donated item within three years of receiving it, and the donor had filed Form 8283 to claim a deduction for the contribution, the nonprofit must complete Form 8282 and send a copy to the donor and the IRS.

Make the most of your nonprofit in-kind contributions.

If you’re unsure of in-kind contribution accounting as a donor or nonprofit, the nonprofit advisors at Abdo can help. We’ll guide you through complying with the requirements associated with these types of gifts and make sure you do it right.

If you’d like to hear more about how we can give you clarity around in-kind contribution accounting, contact us today.

February 15, 2024

Reach out to our team

Let's discuss

Interested in discussing this topic further? Fill out this form to get in touch with our advisors and get the conversation started. Together, we can help light the path forward to a brighter future.

"*" indicates required fields