Article

What Every Employer Should Know About Sick Pay

The IRS defines sick pay as an amount paid under a plan to an employee who is unable to work because of sickness or injury. Sick pay may be paid by an employer or a third party, such as an insurance company, and includes both short- and long-term disability benefits.

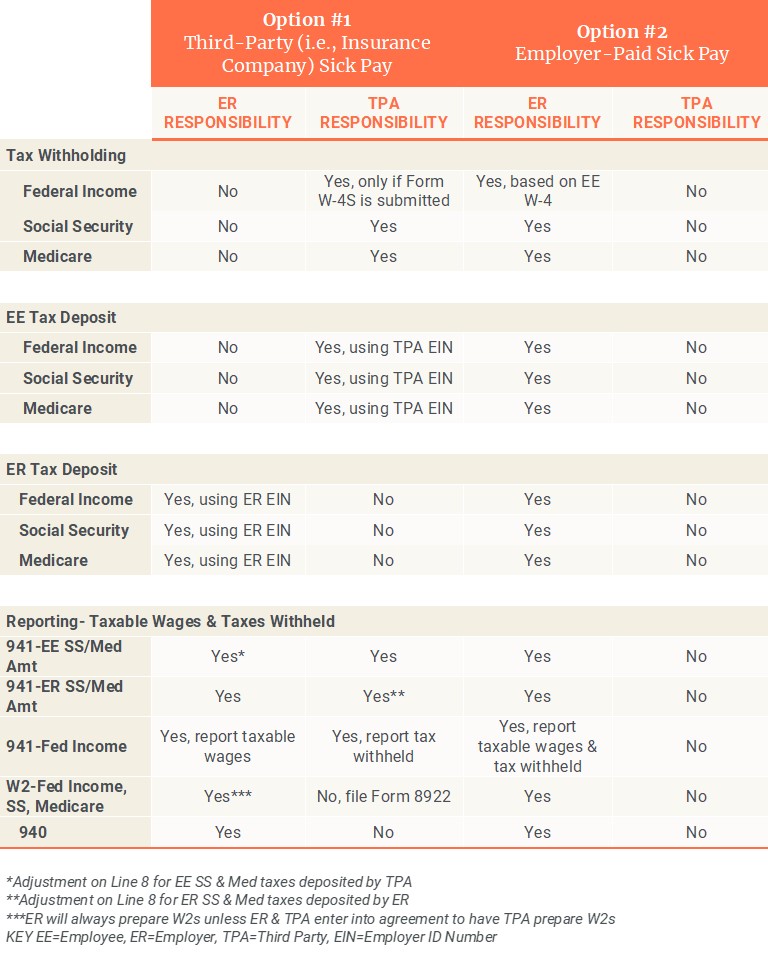

Sick pay is commonly paid out within companies. However, the tax and reporting rules regarding its payments can be both complex and confusing, especially since there are several ways sick pay plans can be set up. It’s important to know how your company’s plan is structured, so your tax deposits and payroll tax filings are submitted correctly.

Here are a few things you should know about the IRS tax and reporting rules regarding sick pay.

Sick pay, including both short- and long-term disability payments, received within six months of an absence is subject to Social Security, Medicare, and federal unemployment (FUTA) taxes. Depending on whether the payer was an employer or a third party, sick pay may also be subject to federal income tax withholding. All tax deposits must be filed in a timely manner and follow the same deposit rules as regular payroll tax deposits. Types of payments that are not subject to tax withholding, no matter who pays them, include payments made after an employee’s death, payments that exceed the Social Security wage base, payments made after six months absence from work, and payments paid for by employee premium contributions.

For additional details, please see the table below:

Finally, if your company has a sick pay plan, be sure to track which employees have taken time off of work throughout the year and stay informed about your internal policies and contracts with third-party administrators. It’s also important to verify with your third-party administrator or CPA that you are receiving and correctly reporting quarterly and annual third-party sick pay statements.

If you have additional questions about the topic of sick pay, please know we’re here to help. Contact our team today.

September 27, 2022

Meet the Expert

Reach out to our team

Let's discuss

Interested in discussing this topic further? Fill out this form to get in touch with our advisors and get the conversation started. Together, we can help light the path forward to a brighter future.

"*" indicates required fields