Article

Measuring credit losses on financial statements

ASU 2016-13 Measurement of Credit Losses on Financial instruments

New model referred to as “current expected credit loss” (CECL)

Under current GAAP, losses on financial assets are recognized upon becoming probable that a loss has been incurred. For example, the allowance for doubtful accounts is adjusted for a potential uncollectible invoice when it surpasses a certain threshold for days outstanding. The loss was recorded for a specific invoice, or group of invoices, when it became probable that it was not collectible.

Under ASU 2016-13, entities will be required to measure expected credit losses for all financial assets on the balance sheet date. Management will need to consider all forward-looking information when determining its allowance for credit losses. The allowance should be based on historical experience, current conditions, and reasonable and supportable forecasts; and should be estimated based on the expected credit losses over the entirety of the asset’s life. This requires an entity to recognize an allowance of lifetime (not only annual) expected credit losses. As the new standard removes the threshold of “probable” an estimated reserve would typically be required even if the risk of loss is remote.

Examples of financial assets that are within the scope of CECL:

- Loan Receivables and Notes Receivable.

- Held to maturity debt securities.

- Trade receivables and contract assets that result from revenue transactions or other income.

- Loans to officers and employees.

- Reinsurance recoverables from insurance transactions.

Examples of financial assets not included in CECL:

- Financial assets measured at fair value.

- Available for sale debt securities

- Promises to give (pledge receivables) of a not-for-profit entity.

Management is responsible for developing, maintaining, and documenting a systematic, disciplined, and consistently applied process for determining the Allowance for Credit Losses. Management’s methodology for estimating credit losses should be documented and should include explanations and rationale for their judgements made in determining the allowance.Additionally, the CECL model requires consideration of reasonable and supportable forecasts, and when necessary, reversion to historical loss information is acceptable, depending on facts and circumstances.

The allowance for credit losses may be determined using various methods including the discounted cash flow methods, loss-rate methods, probability-of-default methods, or methods that utilize an aging schedule.

For trade receivables (or any assets with similar risk characteristics), CECL requires them to be evaluated on a collective (or pooled) basis.

Financial assets will be presented on the balance sheet at the net amount expected to be collected.

Credit losses for newly recognized assets and adjustments to expected credit losses previously recognized will be presented on the income statement.

Example

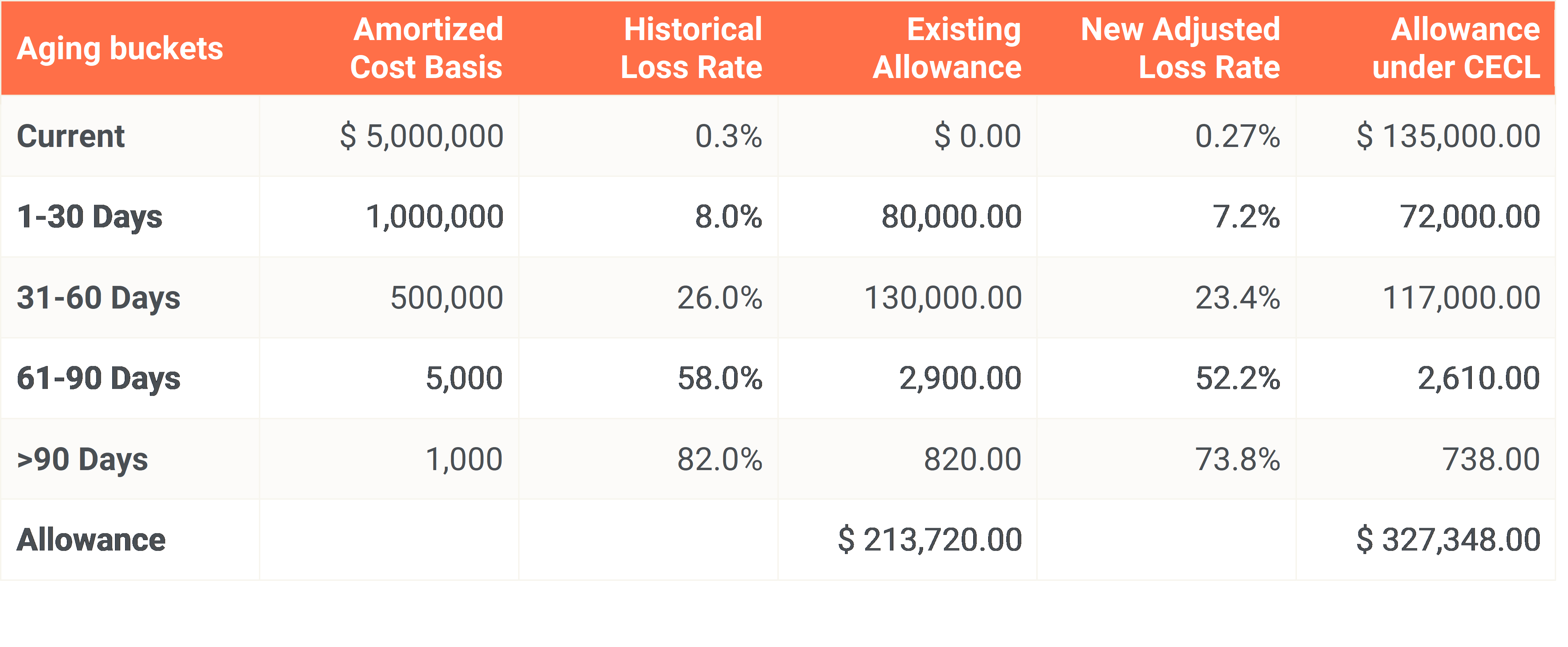

The following example is adapted from ASC 326-20-55-37 and illustrates one way an entity may estimate expected credit losses for trade receivables using an aging schedule:

A manufacturer has tracked historical loss information for its trade receivables and compiled the following historical credit loss percentages:

- 0.3% for current receivables

- 8% for receivables that are 1-30 days past due

- 26% for receivables that are 31-60 days past due

- 58% for receivables that are 61-90 days past due

- 82% for receivables that are more than 90 days past due

The entity believes the historical loss information is a reasonable base to determine expected credit losses for trade receivables held at the reporting date because the composition of the trade receivables at the reporting date is consistent with that used in developing the historical credit-loss percentages. However, management has determined that the current reasonable and supportable forecasted economic conditions have improved when compared to the economic conditions using the historical information. The entity has observed that unemployment has decreased and expects there will be an additional decrease in unemployment over the year. Based on its past experience for similar decreases in the unemployment rate, management adjusts the historical loss rates to reflect the difference in current conditions and forecasted changes as seen below:

Meet the Expert

November 7, 2023

Please note: Operational and regulatory guidance is frequently changing and the information included here may be out of date—please consult the latest guidance and with your advisor before taking action.

Reach out to our team

Let's discuss

Interested in discussing this topic further? Fill out this form to get in touch with our advisors and get the conversation started. Together, we can help light the path forward to a brighter future.