Article

Engineering solutions: Leveraging the R&D tax credit for your engineering firm

From major infrastructure projects to the latest tech developments, engineering firms are often leading the charge in innovation. One key tool for your firm is the Research & Development (R&D) Tax Credit under Section 41 of the Internal Revenue Code, which helps you leverage innovation and reinvest in your own growth.

Rewarding engineering innovation

First introduced in 1981, the R&D tax credit recognizes the crucial role innovation plays in driving economic growth and global competitiveness. Initially aimed at traditional industries, the credit now covers the broad field of engineering, emphasizing the importance of research and development in shaping the future of infrastructure and technology. Essentially, the R&D tax credit encourages you to invest in innovation by rewarding activities that involve discovering or improving products, processes, techniques, formulas, or inventions.

Ready for your feasibility analysis? Click here to get started.

Qualifying activities for engineering firms

To qualify for the R&D tax credit, you need to show that your activities truly embody innovation. This often involves tackling technological uncertainties—solving complex problems with new designs, developing advanced materials, or integrating state-of-the-art technologies. Your firm is constantly exploring new frontiers where outcomes are not guaranteed.

The R&D tax credit values activities that apply principles of engineering or physical sciences. This includes everything from conceptualizing and designing new products or processes to implementing and testing innovative solutions. Whether developing sophisticated algorithms for predictive modeling, designing complex mechanical systems, or optimizing energy-efficient solutions, your firm engages in a wide range of innovative activities.

Moreover, the R&D tax credit supports the pursuit of innovative solutions to technical challenges. In your firm, this often involves prototyping, testing, and iterative experimentation to refine products and processes. From developing new construction techniques to enhance structural integrity to refining processes for better efficiency and sustainability, you are always innovating in your quest for excellence.

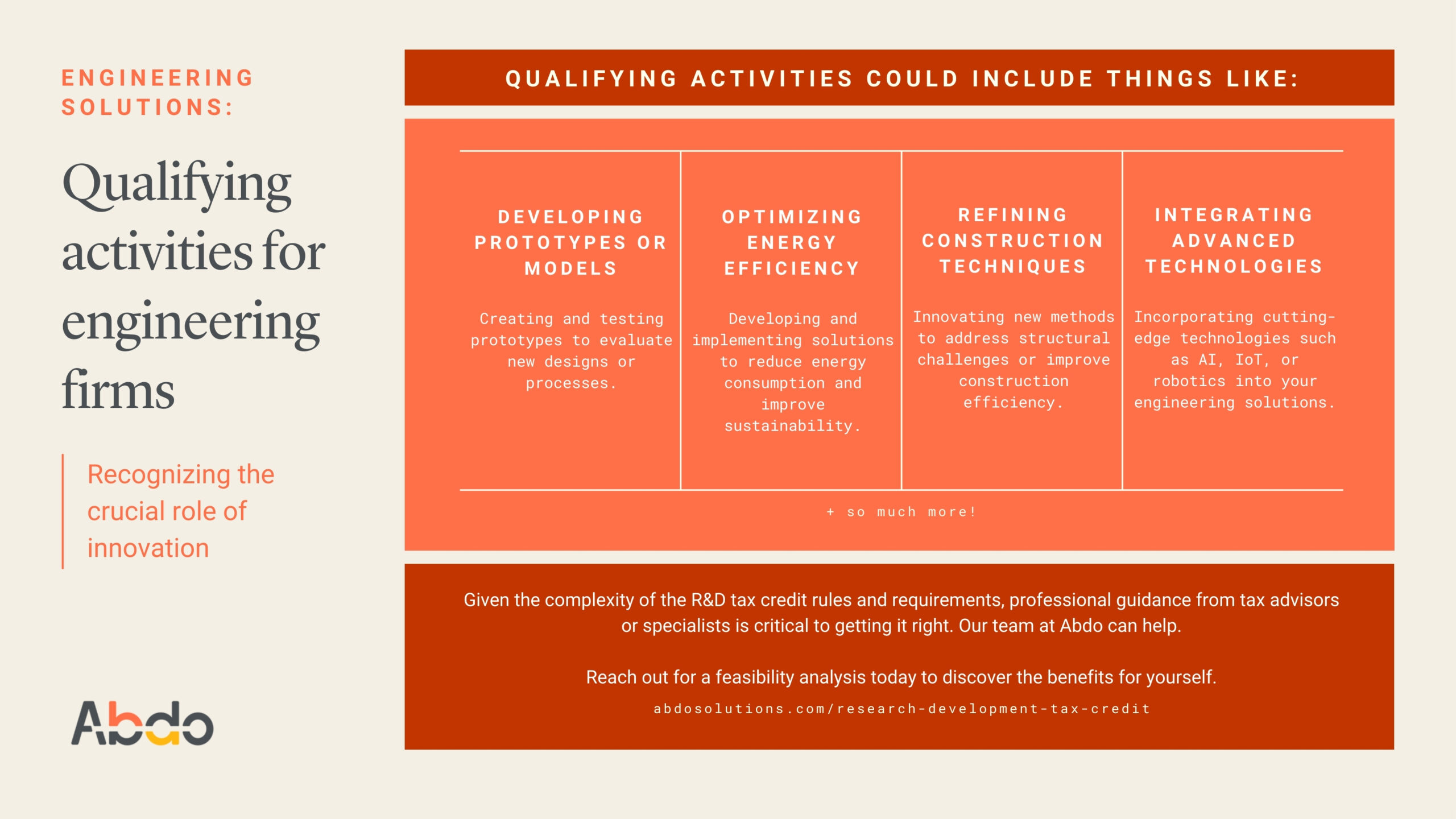

Here are some qualifying activities that you can leverage to take advantage of the R&D tax credit:

- Designing new products or improving existing ones: Innovations in product design that offer new functionalities or improved performance.

- Developing prototypes or models: Creating and testing prototypes to evaluate new designs or processes.

- Conducting feasibility studies: Researching and evaluating the feasibility of new engineering concepts or processes.

- Enhancing manufacturing processes: Implementing new techniques or processes to improve efficiency, quality, or cost-effectiveness in manufacturing.

- Developing new materials: Researching and creating new materials with enhanced properties or performance characteristics.

- Integrating advanced technologies: Incorporating cutting-edge technologies such as AI, IoT, or robotics into your engineering solutions.

- Optimizing energy efficiency: Developing and implementing solutions to reduce energy consumption and improve sustainability.

- Performing environmental impact assessments: Researching and developing methods to minimize the environmental impact of your engineering projects.

- Creating complex algorithms: Designing and testing advanced algorithms for predictive modeling, simulation, or optimization.

- Refining construction techniques: Innovating new methods to address structural challenges or improve construction efficiency.

Guiding you through the complexities

Given the complexity of the R&D tax credit rules and requirements, professional guidance from tax advisors or R&D tax credit specialists is critical to getting it right. Our advisors can help identify qualifying activities, maximize eligible expenses, and ensure compliance with IRS regulations, increasing the chances of a successful claim. Learn about the guidance our team can offer and then reach out for a feasibility analysis to discover how much you could save.

July 19, 2024

Meet the Expert

Reach out to our team

Let's discuss

Interested in discussing this topic further? Fill out this form to get in touch with our advisors and get the conversation started. Together, we can help light the path forward to a brighter future.

"*" indicates required fields