Article

Can your business qualify for the R&D tax credit?

The Research and Development (R&D) Tax Credit is a tax incentive designed to encourage companies across various industries to invest in growth and innovation. The credit is not restricted to any single industry and can be a significant boon to businesses that are investing in developing new, improved, or technologically advanced products, processes, principles, methodologies, or materials. In this guide, we’ll explore some examples of how different industries can qualify for the R&D tax credit. To find more examples of qualifying industries or learn more about our R&D tax credit services, click here.

But first, what is the R&D tax credit?

The R&D Tax Credit is a tax incentive that encourages businesses to invest in innovative activities. It was introduced with the aim of stimulating economic growth and allowing American businesses to compete on a global scale. The credit allows businesses to reduce their tax liability based on a percentage of their qualifying R&D expenditure, which can include wages, supplies, research costs, and even contract research expenses.

The beauty of the R&D tax credit is that it is not confined to white lab coats and microscopes; it embraces a broad spectrum of activities that many businesses perform in their ordinary operations.

The IRS defines R&D in a broad sense, encompassing any activity or project undertaken for the purpose of improving existing products, creating new products, or improving or creating manufacturing or software processes. This broad definition enables a multitude of industries to benefit from the tax credit. As long as the work being done meets the four-part test (LINK to 4 part test section of the R&D webpage here), it may qualify for the credit.

The aim of this credit is to foster innovation across all sectors, driving economic growth and maintaining America’s position as a global leader in technological advancement. Therefore, it’s crucial for businesses across these various industries to understand how they can benefit from this tax credit.

How manufacturing firms can qualify for the R&D tax credit

In the world of manufacturing, innovation is key to staying competitive. Businesses in this sector often invest in R&D to improve production processes, design and develop new products, enhance product quality, or ensure compliance with regulatory standards. This can include everything from automated assembly line processes to new methods of material handling. These activities can potentially qualify for the R&D tax credit, providing significant savings that can be reinvested into further innovation. Find out how maximizing innovation can help manufacturers qualify for the R&D tax credit.

Businesses in this sector often invest in R&D to improve production processes, design and develop new products, enhance product quality, or ensure compliance with regulatory standards. Examples of qualifying activities might include:

- Developing new or improved manufacturing processes

- Designing and testing product prototypes

- Creating environmentally friendly manufacturing processes

- Enhancing product durability or reliability

- Automating or streamlining processes to improve efficiency

The R&D tax credit for the food & beverage industry

The Food & Beverage industry is constantly evolving with new recipes, cooking methods, and packaging technologies. Innovations can be as diverse as creating new food preservation techniques or developing gluten-free or allergen-free products. Whether you’re a restaurant developing unique culinary techniques, a brewery experimenting with brewing processes, or a food manufacturer working on innovative packaging solutions, your R&D efforts could qualify for tax credits. Could your food, beverage, or agriculture business qualify for the R&D tax credit?

In the food and beverage industry, the savings possibilities are everywhere and many of the normal, everyday activities you do to run your business may qualify for tax credits. Examples of qualifying activities might include:

- Developing new recipes or food preparation techniques

- Creating new or improved brewing or distilling processes

- Innovating food preservation or packaging methods

- Improving food safety and hygiene processes

- Experimenting with new ingredients or food combinations

Benefits of the R&D tax credit for the healthcare industry

The healthcare industry is a prime example of a sector where research and development are crucial. This can include efforts to improve patient care, enhance data management systems, or create new medical imaging technologies. From new medical procedures and drug development to advancements in medical devices and healthcare software solutions, R&D is pervasive in this industry. Such activities often qualify for the R&D tax credit, reducing the financial burden of innovation. Could your healthcare business benefit from the R&D tax credit?

Examples of qualifying activities might include:

How builders & remodelers can leverage the R&D tax credit

You might not immediately associate the building and remodeling industry with R&D, but this sector often involves significant innovation. This could range from developing energy-efficient building techniques to creating new techniques and processes in construction. From developing eco-friendly construction methods to designing custom architectural features, these activities could potentially qualify for the R&D tax credit and builders and remodelers should consider their use of the R&D tax credit accordingly.

If you’re unsure how the R&D tax credit could fit into your tax planning, you may be surprised by the number of activities that can qualify for builders and remodelers. Examples of qualifying activities might include:

- Creating new or improved construction methods or materials

- Developing energy-efficient or green building techniques

- Designing customized architectural or design features

- Improving safety features or protocols

- Innovating project management or scheduling methodologies

How to leverage the R&D tax credit for your software company

In the rapidly evolving world of software, R&D is integral. This could involve creating new algorithms, improving software performance, or developing new data security measures. Through developing new applications, enhancing existing software, integrating systems, or creating innovative user interfaces, your business activities can potentially qualify for the R&D tax credit, fostering further innovation. Discover how to leverage the R&D tax credit for your own software company.

Examples of qualifying activities might include:

- Creating new or improved software applications or systems

- Enhancing user interfaces or user experience

- Developing new algorithms or data processing techniques

- Improving software security or encryption methods

- Streamlining database management or data retrieval methods

Engineering solutions: Leveraging the R&D tax credit for your engineering firm

Engineering firms, whether they specialize in civil, mechanical, electrical, environmental, or any other discipline, are often involved in R&D activities. These could include devising new methods for waste management in civil engineering or creating a more efficient engine design in mechanical engineering. From designing innovative structures to creating new engineering processes or materials, these efforts can qualify for the R&D tax credit, creating tax savings and leveraging existing business activities.

Examples of qualifying activities might include:

- Creating new or improved engineering designs or processes

- Developing new materials or structures

- Enhancing the efficiency or sustainability of engineering projects

- Innovating waste management or recycling methods

- Designing customized machinery or equipment

Find out how your engineering firm could qualify for the tax credit.

Architecture and the R&D tax credit

In the field of architecture, R&D is often undertaken to create aesthetically pleasing, functional, and sustainable designs. This could involve researching new materials to improve the sustainability of buildings or creating designs that improve a building’s energy efficiency. Whether it’s developing new design methodologies, using novel materials, or integrating advanced technology into designs, these activities can potentially qualify for the R&D tax credit. Discover how to unlock tax savings with the R&D tax credit for your architectural firm.

Examples of qualifying activities might include:

- Developing innovative architectural designs or concepts

- Creating new or improved design methodologies

- Integrating new technology into architectural designs

- Designing energy-efficient or sustainable buildings

- Experimenting with new materials or construction techniques

Not just by industry, but also by state: State-specific R&D tax credits

While the federal R&D tax credit is available to businesses across the U.S., it’s important to remember that many states offer their own R&D tax credits, each with its own regulations and qualifications. These state-level incentives can significantly enhance the overall benefit for companies investing in innovation.

In addition to qualifying for the federal credit, businesses may also be eligible to claim these state credits, effectively doubling their tax savings. However, the rules governing state R&D tax credits can vary widely, so it’s crucial to understand the specific regulations in your state.

Let’s take a closer look at two states – Minnesota and Arizona:

- Minnesota: The state of Minnesota offers the Research and Development Tax Credit to both C corporations and pass-through entities. This credit is equal to 10% of qualifying expenses up to $100,000 and 2.5% for expenses above that amount. The credit can be carried forward for up to 15 years.

- Arizona: Arizona provides the Research and Development Income Tax Credit, which is available to taxpayers who incur qualified research expenses in the state. The credit is equal to 24% of the first $2.5 million in qualifying expenses, and 15% of the qualifying expenses exceeding that amount. Any unused credit can be carried forward for up to 15 years.

These are just two examples, and the specifics can change as new legislation is passed. Therefore, it’s important to consult with a tax advisor or your state’s Department of Revenue to understand the current regulations and how they apply to your business.

Each state’s Department of Revenue or Taxation website is a valuable resource for understanding the state-specific R&D tax credits available. They often provide comprehensive information about the tax credit, including eligibility criteria, calculation methods, and application procedures. Similarly, state Economic Development Agencies often provide detailed information about various business incentives, including R&D tax credits. They can be a valuable resource for understanding the broader context of the state’s business incentives. The IRS provides a list of state government websites for easy access to the verified pages for each state.

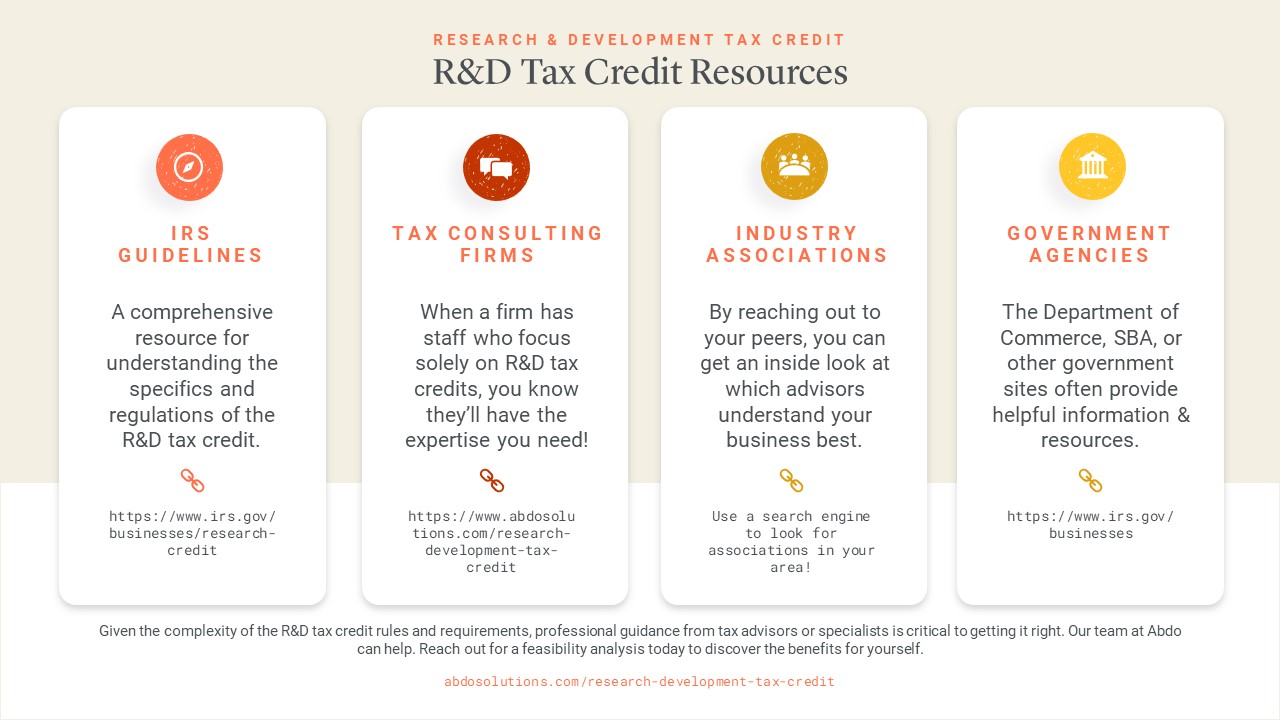

Additional R&D tax credit resources

To help you navigate the complexities of the R&D tax credit, here are some resources you can tap into for further understanding and guidance:

- IRS Guidelines: The Internal Revenue Service’s website is a comprehensive resource for understanding the specifics of the R&D tax credit. It provides detailed information about the credit, including eligibility criteria, how to calculate the credit, and documentation requirements.

- Tax Consulting Firms: Accounting and advisory firms often have staff that focus on R&D tax credits. They can provide personalized guidance based on your business and industry, helping you identify qualifying activities and expenses, and even assist with the application process. At Abdo, we have a dedicated R&D tax credit team with the knowledge and experience to help guide you through the process.

- Industry Associations: Industry-specific associations can provide insights into how the R&D tax credit applies to your sector. They often host webinars and seminars, publish articles, and provide resources specifically related to R&D activities in your industry.

To find trade associations, search online for your industry and location to discover a list of groups near you.

- Government Agencies: Apart from the IRS, other government agencies such as the Department of Commerce, the Small Business Administration, or state government websites often provide useful information and resources related to the R&D tax credit.

Minnesota Department of Commerce

IRS: Qualified Small Business Payroll Tax Credit for Increasing Research Activities

Remember, the R&D tax credit can be a valuable financial tool for your business. Taking the time to understand it and seeking professional advice can ensure you maximize your entitlement while remaining compliant with the law.

The R&D tax credit is a valuable opportunity for businesses across various industries to offset the costs associated with innovation. By understanding the qualification criteria and properly documenting R&D activities, businesses can potentially reap significant financial benefits while contributing to their industry’s advancement.

Our team at Abdo has a wealth of experience in leveraging R&D tax credits for a wide range of business types. From manufacturers and engineers, to software and architects, we can guide your business through the R&D study, documentation, and claiming of the credit so you can reap the benefits of this incentive. Learn more about our services and request a feasibility analysis today!

July 31, 2024

Meet the Expert

Reach out to our team

Let's discuss

Interested in discussing this topic further? Fill out this form to get in touch with our advisors and get the conversation started. Together, we can help light the path forward to a brighter future.

"*" indicates required fields