Arizona Qualified Facility Tax Credit

Unlocking powerful tax savings for your business

At Abdo, we partner with you to help your business maximize financial potential through strategic tax planning. One of the most valuable opportunities available to companies in Arizona is the Qualified Facility Tax Credit, an incentive designed to support businesses that are investing in new facilities, creating jobs, and stimulating economic growth in the state.

Let's Dive In

What is the Arizona Qualified Facility Tax Credit?

The Arizona Qualified Facility Tax Credit is a program administered by the Arizona Commerce Authority (ACA) that provides tax incentives to businesses that make substantial capital investments and create quality jobs in the state. This program aims to attract and retain high-value industries, thereby boosting Arizona's economy.

Who can qualify?

Eligibility requirements

To qualify for the Arizona Qualified Facility Tax Credit, businesses must meet specific criteria, including:

Capital Investment

Companies must make a minimum capital investment in new or expanded facilities. This investment can include expenditures for land, buildings, and equipment.

Job Creation

Businesses must create a certain number of net new full-time jobs that meet wage requirements set by the ACA. These jobs must be maintained for a specified period.

Industry Focus

Any industry that has made a large capital investment as well as drastically increased jobs in the state of Arizona over the past five years has the potential to qualify for this credit.

Benefits of the tax credit

The Arizona Qualified Facility Tax Credit offers significant financial benefits, including:

Income Tax Credit

Eligible businesses can receive a refundable income tax credit based on their capital investment and job creation.

Significant Credits Over Time

Credits are claimed, reported, and paid over five consecutive taxable years. For example, we recently had a client who invested $10,000,000 and added 100 jobs. This client is getting approximately $1,000,000 in refundable credits over 5 years.

Enhanced Competitiveness

By reducing tax liabilities and increasing cashflow, businesses can reinvest savings into further growth and development, enhancing their competitive edge.

How Abdo can light the path forward

Navigating the complexities of tax incentives can be challenging, but Abdo is here to guide you through every step of the process. Our team of experienced accountants and tax professionals will evaluate your business's eligibility for the Arizona Qualified Facility Tax Credit and other available incentives. They'll assist in preparing and submitting the required documentation to the ACA, ensuring that the process is smooth and efficient.

We'll guide you through the process to help you maximize the tax credit benefits, ensuring you receive the full financial advantage available under the program.

Reach out to our team

Get the discussion started today!

Investing in Arizona's future has never been more rewarding. Contact our team today to learn more and discover how your business can benefit from this valuable incentive.

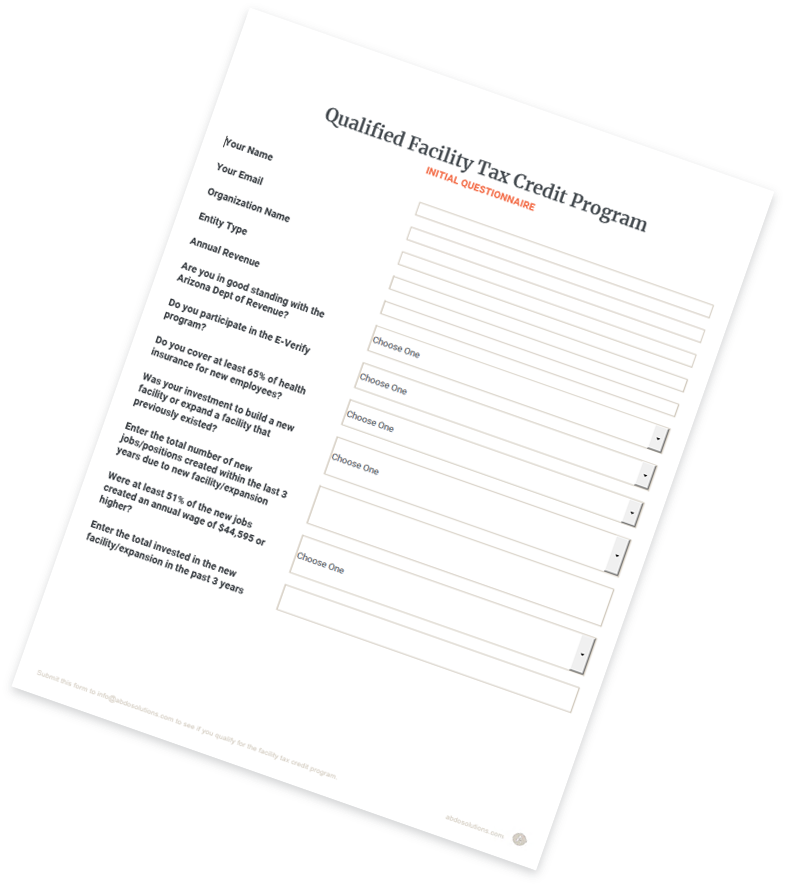

Don't forget to upload your completed questionnaire to the form so we can get started right away!

"*" indicates required fields

Tax Credit Expertise

Guiding you to the best way forward

Our industry-specific experience delivers proactive problem-solving for any challenge. Reach out to our team today.