Article

In financial planning, forecasts and projections aren’t the same

Businesses are rightly encouraged to regularly generate professionally prepared financial statements. Doing so is important for both understanding your own financial position and providing accurate, comprehensive information to stakeholders such as investors, lenders and advisors.

However, keep in mind that financial statements are historical records. They depict the state of the company at a given point in time — not where it will likely be in the future. For the latter purpose, you need to create either a forecast or a projection. But aren’t those two things the same? Not exactly.

Making the distinction

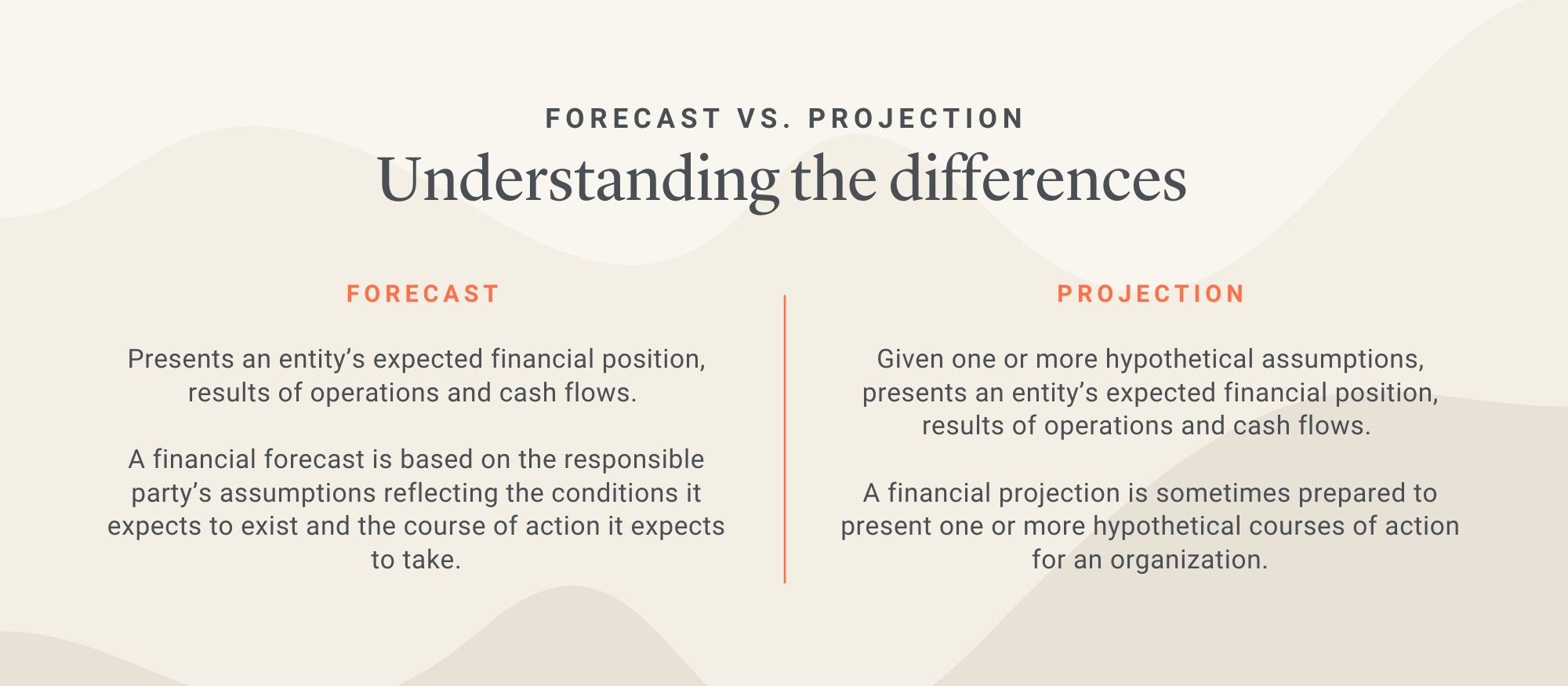

Indeed, the terms “forecast” and “projection” are sometimes used interchangeably. However, as the AICPA’s definitions make clear, there’s a noteworthy distinction. That is, a forecast represents expected results based on the expected course of action. These are the most common type of prospective reports for companies with steady historical performance that plan to maintain the status quo.

On the flip side, a projection estimates the company’s expected results based on various hypothetical situations. These statements are typically used when management is uncertain whether performance targets will be met. Thus, they may be more appropriate for start-ups, fast-growing or transforming companies, or businesses evaluating long-term results where customer demand or market conditions will likely change.

Rolling along

Regardless of whether you opt for a forecast or projection, the report will generally be organized using the same format as your financial statements — with an income statement, balance sheet and cash flow statement. Most prospective statements conclude with a summary of key assumptions underlying the numbers. Such assumptions should be driven by your company’s historical financial statements, along with a detailed sales budget for the year.

Instead of relying on static forecasts or projections — which can quickly become outdated in an unpredictable marketplace — some companies now use rolling 12-month versions that are adaptable and look beyond year-end. Doing so enables you to better identify and respond to weaknesses in your assumptions, as well as unexpected changes to your situation.

For example, a business that suddenly experiences a shortage of materials could experience an unexpected drop in sales until conditions improve. If the company maintains a rolling forecast, it should be able to revise its financial plans more effectively for such a temporary disruption.

Getting in the ballpark

Bear in mind that few forecasts or projections are completely accurate. The future really is that hard to predict. However, a carefully created and timely forecast or projection can “put you in the ballpark” of what’s to come and help your business succeed at financial planning. We can assist you in generating properly prepared financial statements as well as useful forecasts and projections.

July 19, 2023

Meet the Expert

Reach out to our team

Let's discuss

Interested in discussing this topic further? Fill out this form to get in touch with our advisors and get the conversation started. Together, we can help light the path forward to a brighter future.

"*" indicates required fields