Tax Highlighter

Important Reminder: How the IRS Contacts Taxpayers

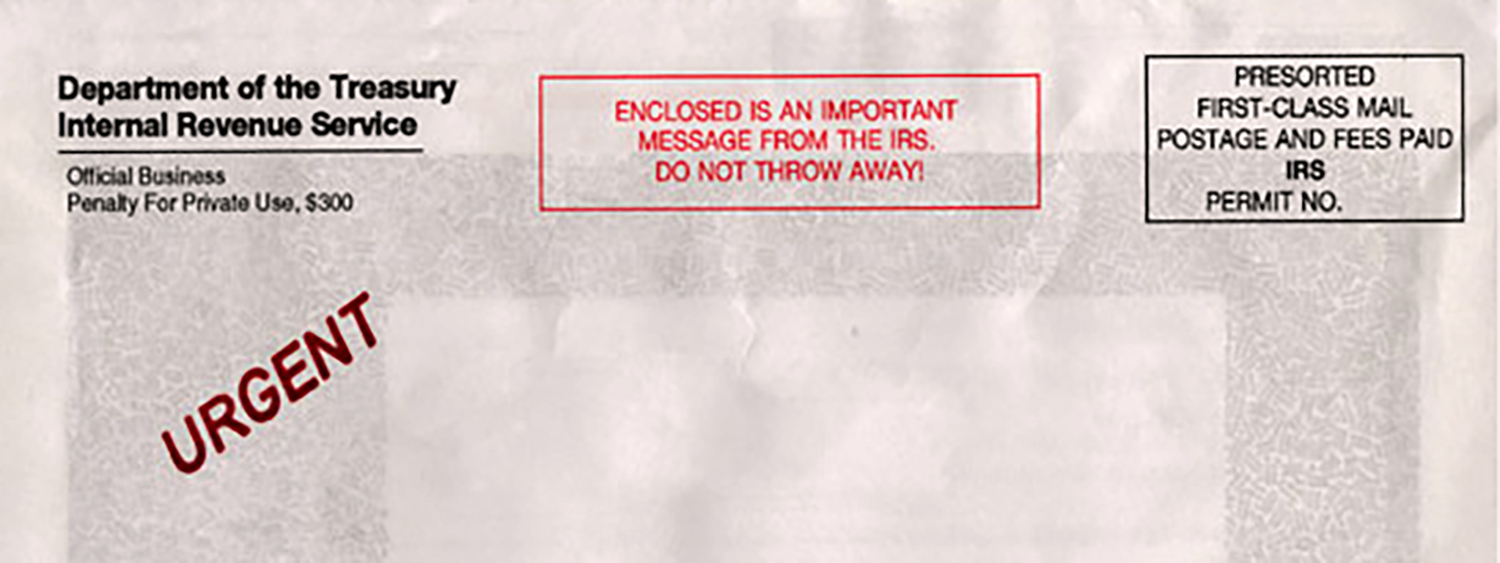

During this busy tax season, the IRS is reminding individuals how it will and, more importantly, won’t contact taxpayers. If the IRS needs to contact you, typically it first delivers a letter through the mail. The agency may call after mailing a notice to confirm an appointment or to discuss an audit. Also, in certain cases, the IRS may make unannounced visits to a taxpayer’s home or place of business to discuss taxes owed. The IRS will never send a text or try to contact you through social media to get personal information or collect taxes, demand immediate payment using a specific payment method, or threaten to have you arrested. For more details, click here, or reach out to our team today.

Posted April 11, 2022

Looking for more?

We post daily tax highlighters to help light the path forward for your business or organization

April 20, 2022

Reach out to our team

Let's discuss

Interested in discussing this topic further? Fill out this form to get in touch with our advisors and get the conversation started. Together, we can help light the path forward to a brighter future.

"*" indicates required fields