Article

Top 10 Tax Opportunities for Contractors

With Abdo’s long history of serving clients in the construction industry, our professionals are always aware of tax changes and other regulations that can cause issues – or that present opportunities. We see ourselves as advisors, not just accountants. To be great advisors for contractors, we must proactively stay on top of ways for our clients in the industry to save on taxes and reduce financial risks.

Here are our top ten tax opportunities to do just that:

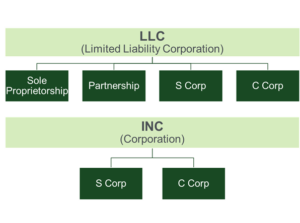

#10: Choose the right entity structure

Choosing the right overall entity structure might be one of the largest tax savers over time. We review your situation to see if a sole proprietorship, S corporation, Partnership or C Corporation is the greatest benefit to you.

#9: Elect the best accounting methods

Many contractors struggle to create well-tuned accounting processes, especially as systems change to support increased activity. There are two principal options for accounting for revenue and expenses: the cash method and the accrual method. Through the cash method, income is recognized when it’s received, which is the best method if your receivables tend to be greater than your payables. This method provides greater flexibility around timing income, and expenses are recognized. With the accrual method, income is recognized when it’s earned and expenses when they’re incurred, and more accurately reflects income and expenses for financial reporting purposes. This is required for contractors with annual receipts of $26 million or more for the last three years.

#8: Select the right compensation for owners

When determining how owners are paid, your entity structure can impact your bottom line. The owners of S corporations can reduce self-employment tax paid by reducing their salary and instead taking money out as draws. Owners will still need to take a reasonable compensation, otherwise the IRS can reclassify draws taken to wages. We can work with you to make sure that a reasonable compensation is maintained while saving on self-employment tax.

#7: Maximize the Qualified Business Income Deduction (QBID)

The QBID deduction is available to sole proprietorships, S corporations and partnerships, but it is not available to C corporations. Contractors fall into what is called a “qualified activity” and can take a 20 percent deduction on net business income. Since the deduction is based on net income, items such as reducing officer’s salary, will increase the QBID deduction. Making planning around maximizing QBID important.

#6: Utilize Section 179 and bonus depreciation

Section 179 allows contractors to write off qualified assets up to $1 million, which include equipment, furniture, vehicles exceeding 6.000 pounds GVW, land improvements, parking lots, leasehold improvements and interior improvements to buildings. Bonus depreciation is like Section 179, but with slight differences. We utilize both of these tools to reduce client taxes.

#5: Take advantage of repair and maintenance regulations

The tangible property regulations determine whether a cost should be capitalized and depreciated for tax purposes, or immediately deducted. They are more complex than the prior rules, but generally more favorable to taxpayers by frontloading deductions, which may lower your effective tax rate.

#4: Take advantage of industry tax credits

If you are looking for tax savings, there are several credits that apply to the construction industry that you should consider. We analyze whether your business qualifies for any of the following credits:

- Employer Retention Credit (ERC)

- Research & Development Credits (R&D)

- Rehabilitation Property Credits

- Energy Efficiency Credits

#3: Choose retirement accounts that maximize your savings

A tax-advantage retirement plan is a great way to save taxes and retain employees. We can assist your business when choosing which plan is best for your business. From simple SEP plans to more elaborate defined benefit plans, we can help lead you in the right direction.

#2: Utilizing the Pass-Through Entity (PTE) payment

Many states, including Minnesota, allow a corporate deduction for state taxes paid on behalf of its shareholders. This credit is available for partnership and S corporations, but more than 50 percent of the shareholders need to make this election. Because Minnesota has such a high tax bracket (9.85 percent), this election can create significant savings.

#1: It’s all about the (tax) brackets

All good tax planning revolves around the owner’s tax brackets and planning what affect incremental income have on this. Often, we are able to leverage multiple planning tools to ultimately reduce your taxes.

What comes next?

While these tax credits and deductions can provide significant savings, fully leveraging the benefits requires some complex calculations. If you have any questions about the savings opportunities and strategies outlined here, or if you’d like more information on how Abdo’s Construction team can help, check out our Real Estate and Construction page.

March 23, 2022

Meet the Expert

Reach out to our team

Let's discuss

Interested in discussing this topic further? Fill out this form to get in touch with our advisors and get the conversation started. Together, we can help light the path forward to a brighter future.

"*" indicates required fields